The Federal Budget 22/23 – Understanding Temporary Full Expensing & The Instant Asset Write Off

What is Temporary Full Expensing?

The instant Asset Write-Off incentive was originally introduced in 2020 as an economic response to the Covid-19 pandemic. The Temporary Full Expensing of Capital Assets measure allows businesses with an aggregated turnover of up to $5 billion, which includes 99% of Aussie businesses, to write off the full expense of eligible brand new assets instantly without any threshold or limit. Even small and medium-sized business with an aggregated turnover of less than $50 million can write off the expense of eligible used assets instantly.

What sort of equipment can you acquire under the Temporary Full Expensing scheme?

This scheme applies to all kinds of assets, including mowers, tractors, and implements. In fact, with the asset value uncapped, it applies to the entire KC Equipment range!

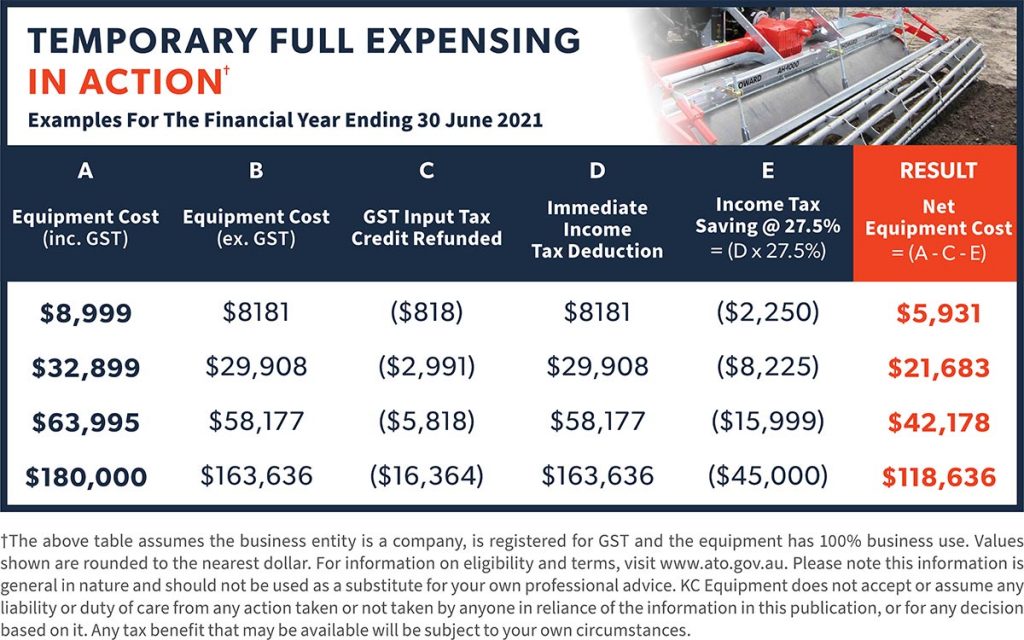

Please note, the asset must be first used (or installed ready for use) by a strict deadline, which is June 30th, 2023. Additionally, to claim the full deduction the asset must be used solely for business purposes. If you want to reduce your tax bill, you can get genuine savings on equipment using this incentive. Have a look at the examples below.

What is the deadline for the Temporary Full Expensing measure?

The deadline for Temporary Full Expensing is approaching, so now is an excellent time for businesses to assess their capital needs and determine whether it is advantageous to make asset acquisitions this financial year. After the temporary full expensing measure expires on June 30th, 2023, businesses will depreciate all capital assets in accordance with the Uniform Capital Allowances rules, subject to the asset’s effective life.

If you’re thinking about purchasing assets, contact your local KC Equipment branch or enquire online as soon as possible to secure your equipment using the Temporary Full Expensing benefits and plan ahead of time. Depending on your business, there may be advantages to using a different depreciation structure, and there are some exceptions to the immediate deductibility threshold. Seeking professional advice is highly recommended to fully understand any tax benefits that may apply to your situation.

For more information, check the ATO and other Government sites. We recommend visiting the Treasury website’s ‘Support for Businesses’ page for more information, along with the official Federal Budget website. Please refer to the ATO or seek professional advice for more information.

If you’d like to talk to KC Equipment about securing equipment using the Temporary Full Expensing scheme, then please visit our contact us page for details on your local branch, or enquire online.

KC Equipment services the Agricultural, Golf, Sports, Commercial and Residential grounds care industries with a huge range of equipment from the world’s leading manufacturers, including Massey Ferguson, Iseki, Kioti and Kubota. With over thirty years of experience, branches in Yatala, Lismore and Murwillumbah, and a huge parts and supplier network, KC Equipment can assist you with all aspects of your operation.

KC Equipment – for everything in your shed.

For any media enquiries, contact Poe Bettany from our Marketing Department on [email protected]