The $20k Small Business Tax Break Is Back, And Has Been Increased For 2019 and 2020

- Changes have recently been made to the $20,000 Instant Asset Write-off. The biggest news is that the $20,000 ex. GST limit has increased to $30,000 ex. GST ($33,000 inc. GST), which opens the door to a huge range of equipment options - such as Compact Tractors - being eligible for immediate deduction. This change was introduced just last month, on April 2nd, 2019. The previous limit was $25,000, introduced January 2019; and $20,000, introduced in May 2015. This change will be active both this financial year (FY18-FY19) and next (FY19-FY20).

Also recently changed is a widening of eligibility for the Instant Asset Write-Off. Previously, the offer was open to small businesses with an aggregated turnover of less than $2million. That changed, increasing to $10 million in July 2016. Now, however, the instant asset write-off may be claimed by both small and medium businesses. This means the offer can apply to businesses with an aggregated turnover of less than $50 million in the 2018-2019 financial year.

And remember - the instant asset write off can be used as many times as you like, so long as each piece of equipment is under the $33,000 inc. GST threshold.

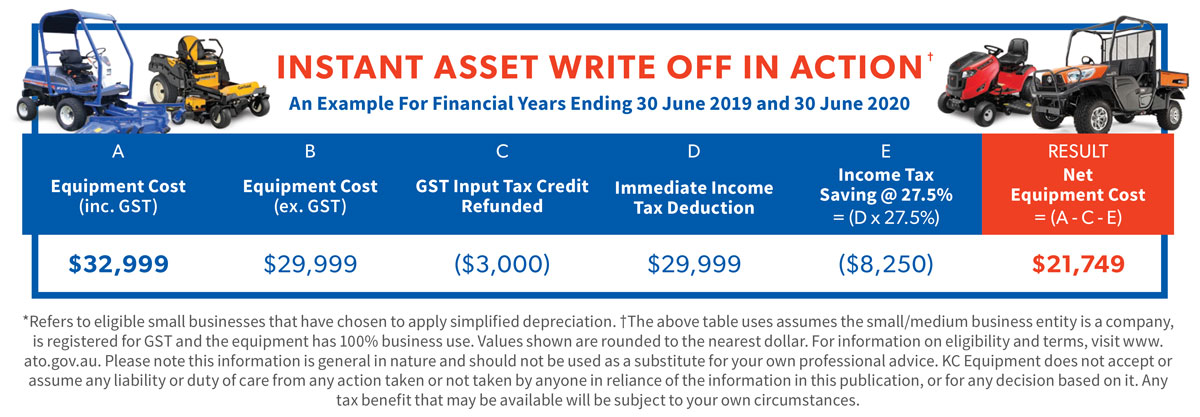

So what does this mean? Eligible businesses can claim an immediate deduction for new and used equipment they purchase, where the cost is less than $33,000 inc. GST . This depreciation deduction is limited to the percentage your asset is used for business. This instant asset write off applies to all kinds of assets, and can include mowers, tractors, slashers and implements. It can even be used on trade-ins, so long as the purchase price of the asset is under the $30,000 ex. GST threshold. If you have a tax bill that you'd like to reduce, then you can get genuine savings on equipment using this incentive. Have a look at the example below:

To learn more, we'd recommend visiting the official ATO website. Depending on your business, there may be benefits to using an alternate depreciation structure, and some exclusions do apply to the immediate deductibility threshold. As always, we'd recommend seeking professional advice to understand any tax benefits that would apply to your own circumstances. You should not act, or refrain from acting, upon the general information presented here without obtaining specific professional advice.

If you'd like to talk to KC Equipment about securing equipment under the $30k Instant Asset Write Off threshold, then please visit our contact us page for details on your local branch, or to enquire online.

KC Equipment services the Agricultural, Golf, Sports, Commercial and Residential grounds care industries with a huge range of equipment from the world’s leading manufacturers, including Massey Ferguson, Iseki, Kubota, and Jacobson. With over thirty years of experience, branches in Yatala, Lismore and Murwillumbah, and a huge parts and supplier network, KC Equipment can assist you with all aspects of your operation.

KC Equipment – for everything in your shed.

For any media enquiries, contact Jean-Paul Mollinger, Marketing Coordinator, on [email protected]